Entering the world of mortgage lending can be both exciting and daunting for new loan officers. This dynamic field requires a blend of financial knowledge, interpersonal skills, and an understanding of the real estate market. For those just starting out, grasping the basics is crucial for a successful career. In this article, we’ll explore the foundational aspects of mortgage lending that every new loan officer should know.

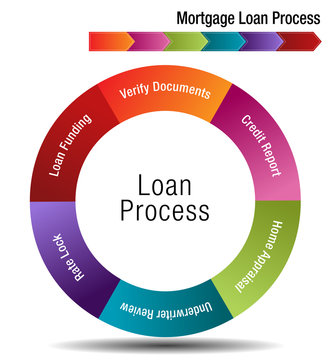

1. Understanding the Mortgage Process

At its core, a mortgage is a loan used to purchase or maintain a home, land, or other types of real estate. The borrower agrees to pay back the loan over a set period, typically 15 to 30 years. Here’s a simplified overview of the mortgage process:

2. Types of Mortgage Loans

There are several types of mortgage loans, each catering to different needs:

3. Key Mortgage Terminology

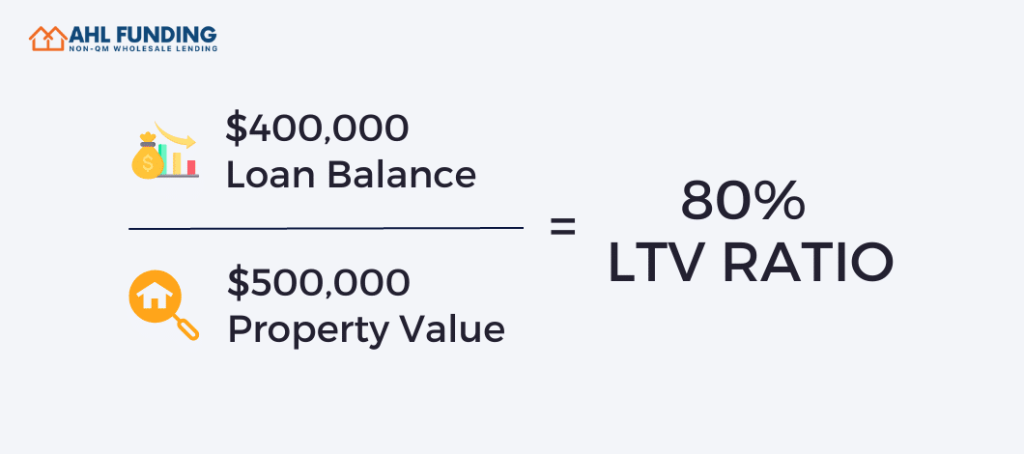

Familiarity with mortgage terminology is vital. Here are some key terms:

4. The Role of Credit in Mortgage Lending

Creditworthiness is central to mortgage lending. A higher credit score can lead to more favorable loan terms. Loan officers should understand how to read and interpret credit reports and guide clients on how to improve their credit scores.

5. The Importance of Customer Service

A loan officer’s role isn’t just about numbers; it’s also about building relationships. Excellent customer service, clear communication, and empathy are crucial. Understanding clients’ needs and guiding them through the loan process is key to success.

6. Continuing Education and Compliance

The mortgage industry is regulated and requires adherence to various laws and guidelines. Continuous learning about new laws, regulations, and market trends is essential. Loan officers must also ensure compliance with these regulations to protect their clients and themselves.

Conclusion:

As a new loan officer, understanding these basics is just the start. The mortgage industry offers a rewarding career path filled with opportunities for growth and learning. For those looking to expand their knowledge and offerings, AHL Funding offers a wealth of resources and innovative loan programs tailored to a diverse clientele.

Ready to take your first step or elevate your career in mortgage lending? Consider partnering with AHL Funding. Begin by exploring AHL Funding’s Broker Approval process. If you have a specific loan scenario in mind, don’t hesitate to submit it through AHL Funding’s Submit a Scenario page for a quick appraisal. With AHL Funding, you’re not just getting a lender; you’re gaining a partner committed to your growth and success in the mortgage industry.

Our goal is to shape and build the next generation of mortgage lending with exceptional customer service, integrity, strength and experience.

© 2024 AHL Funding | Privacy Policy | Company NMLS: 1370963

AHL Funding DBA American Home Loans All rights reserved. www.nmlsconsumeraccess.org. Rates, fees and programs are subject to change without notice. Other restrictions may apply. AHL Funding DBA American Home Loans is a Wholesale Lender. We work with mortgage brokers to originate loans.

Subscribe to AHL Funding and recieve insider news, tips, and resources for loan officers.

*We never spam, unsubscribe any time.