For new loan officers venturing into the world of mortgage lending, mastering key concepts is crucial. One such concept is the Loan-to-Value (LTV) ratio, a critical element in evaluating loan applications. This beginner’s guide aims to demystify the LTV ratio, outlining its importance and how it influences mortgage lending decisions.

1. What is the Loan-to-Value (LTV) Ratio?

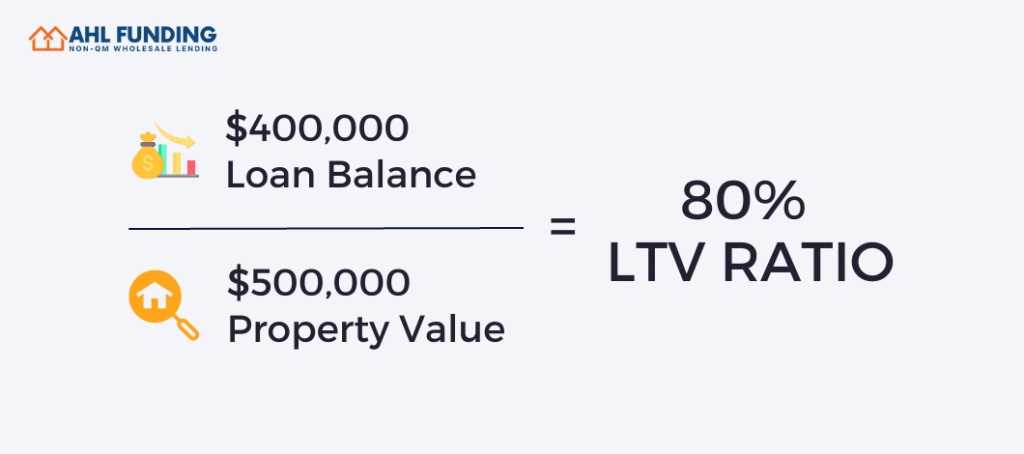

The Loan-to-Value ratio is a metric used to assess lending risk before approving a mortgage. It measures the relationship between the loan amount and the appraised value of the property. Essentially, it answers the question: how much of the property’s value is being financed through the loan?

2. Why is LTV Ratio Important?

3. High LTV Ratios and Their Implications

4. Managing High LTV Ratios

For borrowers with high LTV ratios, there are strategies to improve their loan prospects:

5. LTV in Refinancing

The LTV ratio is also crucial in refinancing situations. A lower LTV can secure better refinancing terms. However, if the property value has decreased, or the borrower seeks cash-out refinancing, the LTV ratio might increase, affecting the loan terms.

6. LTV Ratio and Investment Properties

For investment properties, lenders typically require a lower LTV, as these properties are deemed higher risk compared to primary residences.

Conclusion:

Understanding the Loan-to-Value ratio is fundamental for loan officers. It not only helps in assessing the risk associated with a loan application but also in guiding borrowers to make informed decisions. As a loan officer, ensuring borrowers understand the implications of LTV can aid in their quest for the best possible loan terms.

For those looking to deepen their understanding and engage with a variety of loan scenarios, AHL Funding offers a comprehensive range of resources. Explore your potential with AHL Funding by starting with their Broker Approval process. Additionally, for specific inquiries or loan evaluations, AHL Funding’s Submit a Scenario page is an excellent resource, promising a quick and supportive response. Embrace the opportunity to grow and succeed with AHL Funding as your knowledgeable partner in the mortgage industry.

Our goal is to shape and build the next generation of mortgage lending with exceptional customer service, integrity, strength and experience.

© 2024 AHL Funding | Privacy Policy | Company NMLS: 1370963

AHL Funding DBA American Home Loans All rights reserved. www.nmlsconsumeraccess.org. Rates, fees and programs are subject to change without notice. Other restrictions may apply. AHL Funding DBA American Home Loans is a Wholesale Lender. We work with mortgage brokers to originate loans.

Subscribe to AHL Funding and recieve insider news, tips, and resources for loan officers.

*We never spam, unsubscribe any time.