Down payments are a fundamental aspect of the home-buying process, serving as the buyer’s initial investment in their new property. For loan officers, providing clear, comprehensive guidance on down payments is crucial in helping clients make informed decisions. This article explores the nuances of down payments, their importance, and how loan officers can effectively advise clients.

The Basics of Down Payments

A down payment is the portion of the property’s purchase price that the buyer pays upfront, typically in cash. This amount is not financed through the mortgage loan.

Why Down Payments Matter

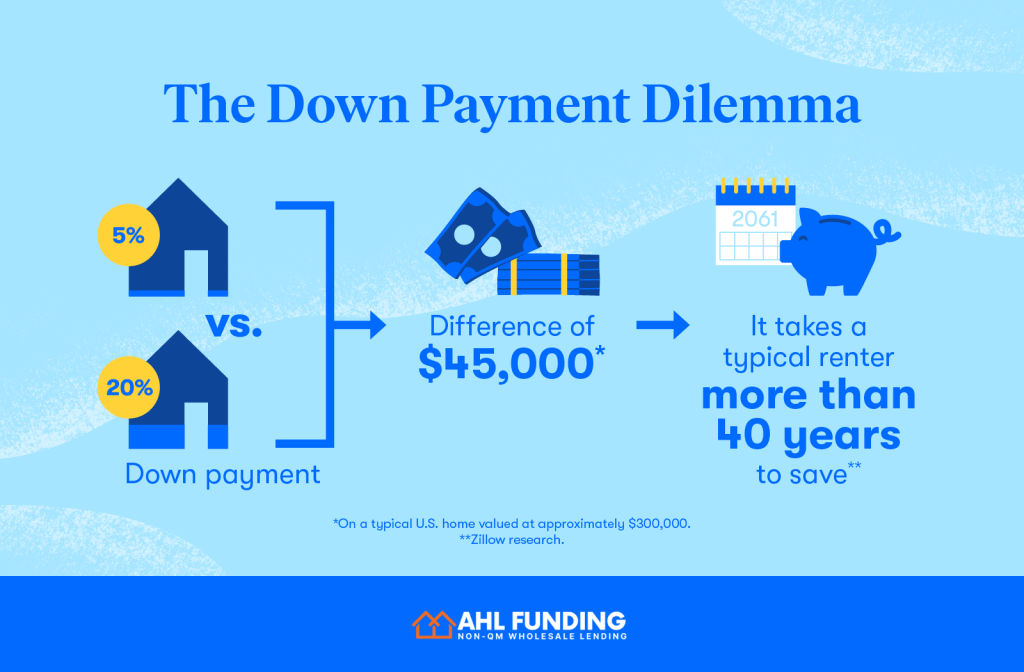

Down payments influence various aspects of the home-buying process:

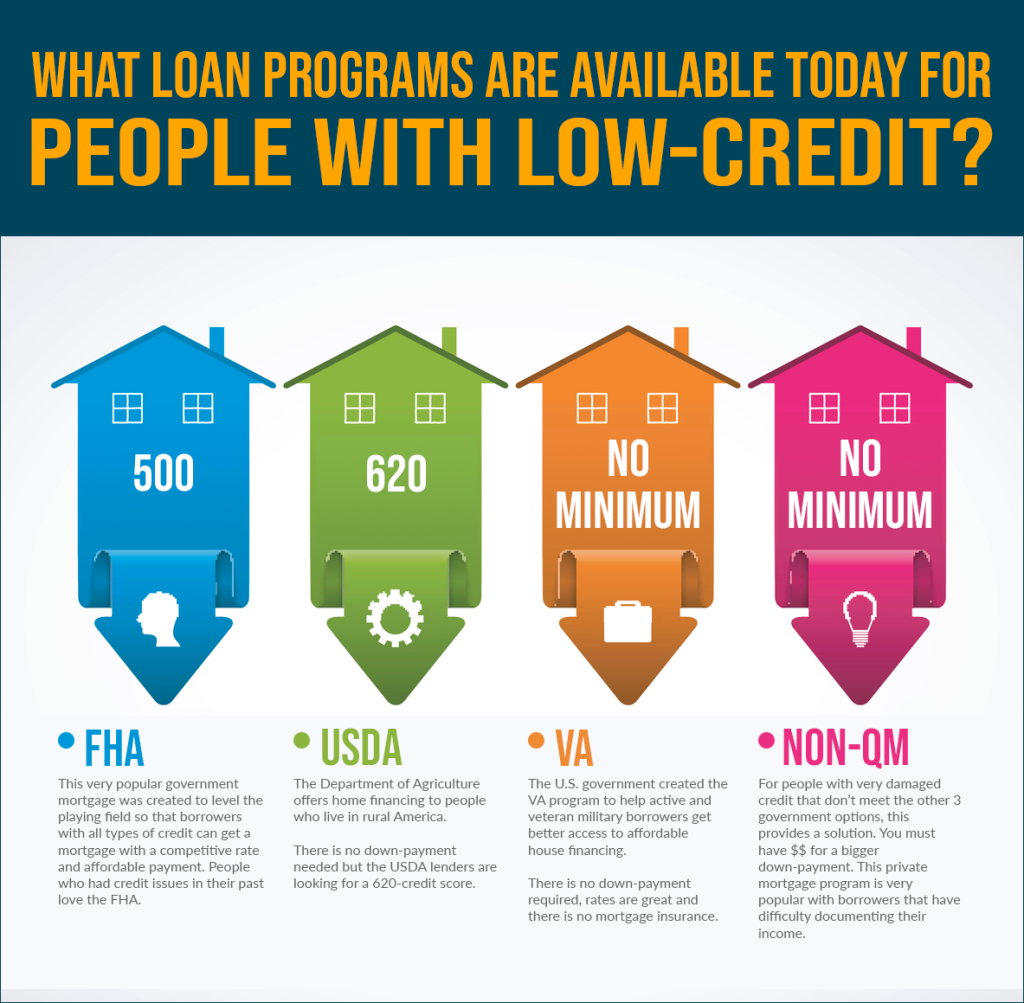

Standard Down Payment Requirements

While down payment requirements can vary, here are some general guidelines:

Advising Clients on Down Payments

Loan officers can support clients by:

Saving Strategies for Down Payments

Encourage clients to:

Navigating Gifted Down Payments

Clients may receive down payment gifts from family or friends. Loan officers should:

Down Payment Myths and Misconceptions

Address common misconceptions, such as:

Conclusion:

Down payments are a critical component of purchasing a home, and loan officers play a vital role in guiding clients through this aspect of the mortgage process. By providing comprehensive advice on down payment requirements, strategies for saving, and available assistance programs, loan officers can empower clients to make well-informed decisions that align with their financial goals.

Loan officers looking to enhance their advisory skills and knowledge base can find valuable resources and support with AHL Funding. To explore partnership opportunities and access a wide range of mortgage solutions, visit AHL Funding’s Broker Approval page. For personalized guidance or to discuss specific client scenarios, AHL Funding’s Submit a Scenario page offers expert assistance, ensuring loan officers are well-equipped to navigate the complexities of down payments and more.

Our goal is to shape and build the next generation of mortgage lending with exceptional customer service, integrity, strength and experience.

© 2024 AHL Funding | Privacy Policy | Company NMLS: 1370963

AHL Funding DBA American Home Loans All rights reserved. www.nmlsconsumeraccess.org. Rates, fees and programs are subject to change without notice. Other restrictions may apply. AHL Funding DBA American Home Loans is a Wholesale Lender. We work with mortgage brokers to originate loans.

Subscribe to AHL Funding and recieve insider news, tips, and resources for loan officers.

*We never spam, unsubscribe any time.