For loan officers, one of the pivotal metrics when evaluating a borrower’s loan application is the Debt-to-Income (DTI) ratio. It’s a clear indicator of a borrower’s ability to manage monthly debt payments relative to their gross monthly income. When navigating the world of Non-QM loans, managing this ratio becomes even more critical.

Why? Non-QM loans, by their very nature, cater to borrowers who might not fit the conventional loan mold. As such, understanding and effectively managing DTI can be the key to unlocking financing for many clients.

Here are some essential tips to ensure you’re optimizing the DTI ratio for your Non-QM loan clients:

1. Understand the Nuances

Before diving deep, familiarize yourself with the specifics of DTI in Non-QM loans:

2. Educate Your Borrowers

Ensuring borrowers understand the implications of DTI can lead to smoother loan processes:

3. Use Alternative Documentation

With Non-QM loans, you aren’t restricted to W-2s or pay stubs:

4. Consider Compensating Factors

DTI is crucial, but it’s just a piece of the puzzle:

5. Stay Updated with Industry Standards

The Non-QM loan sector is dynamic:

Conclusion:

In the world of Non-QM loans, the DTI ratio is an essential, yet flexible metric. With a deeper understanding, effective strategies, and the right lending partners, you can unlock opportunities for a wider range of borrowers. In doing so, you not only elevate your service but also position yourself as a knowledgeable and trusted expert in the field.

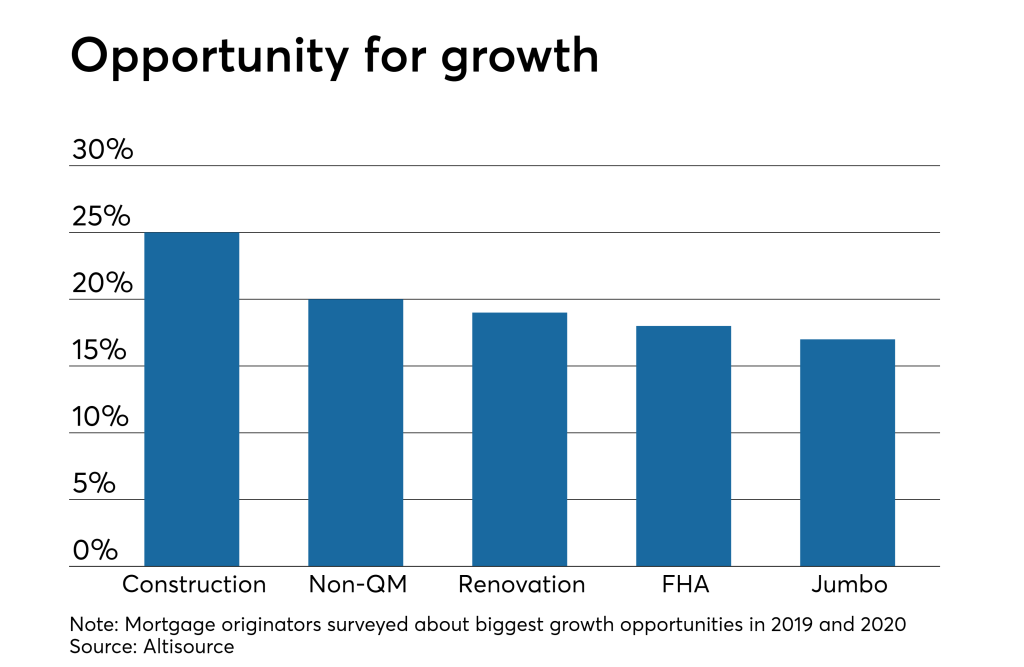

Relevant Statistics:

Interested in diving deeper into the world of Non-QM loans and broadening your client offerings? Explore AHL Funding’s diverse loan solutions tailored for the modern borrower.

Our goal is to shape and build the next generation of mortgage lending with exceptional customer service, integrity, strength and experience.

© 2024 AHL Funding | Privacy Policy | Company NMLS: 1370963

AHL Funding DBA American Home Loans All rights reserved. www.nmlsconsumeraccess.org. Rates, fees and programs are subject to change without notice. Other restrictions may apply. AHL Funding DBA American Home Loans is a Wholesale Lender. We work with mortgage brokers to originate loans.

Subscribe to AHL Funding and recieve insider news, tips, and resources for loan officers.

*We never spam, unsubscribe any time.