For any new loan officer, understanding the role of credit scores in the mortgage approval process is crucial. Credit scores are among the first indicators lenders examine when assessing a borrower’s creditworthiness. This article will delve into why credit scores are important, how they affect mortgage approvals, and what loan officers can do to assist clients with varying credit scores.

1. Understanding Credit Scores

Credit scores are numerical representations of a borrower’s creditworthiness, derived from their credit history. They are calculated based on several factors, including payment history, debt levels, credit age, types of credit, and recent credit inquiries.

2. Why Credit Scores Matter in Mortgage Lending

Credit scores play a pivotal role in the mortgage process for several reasons:

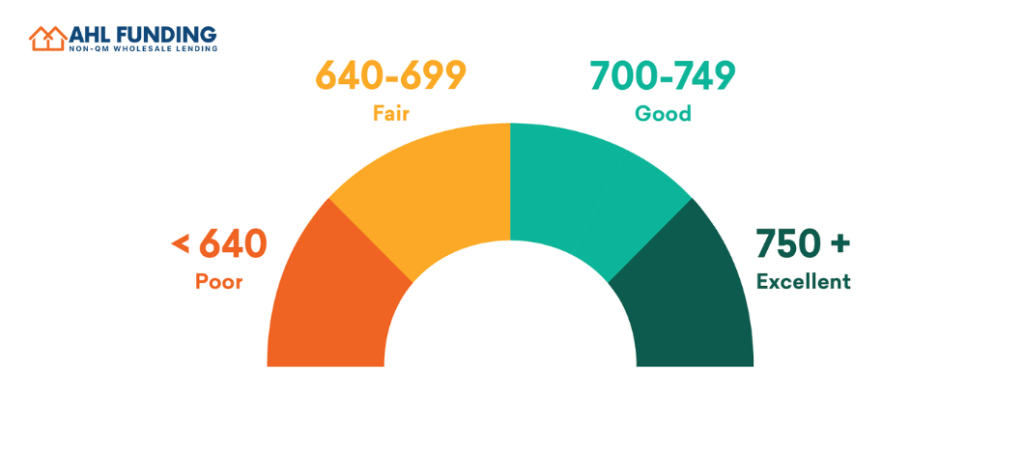

3. Impact of Different Credit Score Ranges

4. Helping Clients with Lower Credit Scores

Loan officers can guide clients with lower credit scores by:

5. The Bigger Picture Beyond Credit Scores

While important, credit scores are not the sole factor in mortgage approvals. Loan officers should also focus on:

6. Continuous Education on Credit Trends

Staying informed about changes in credit reporting and scoring models is vital for loan officers to provide accurate advice to clients.

Conclusion:

In mortgage lending, a credit score is more than just a number; it’s a gateway to understanding a borrower’s financial habits and responsibilities. As a loan officer, guiding clients through the complexities of credit scores and their impact on mortgage approvals is a key part of the role.

For loan officers looking to enhance their expertise and offer tailored solutions to clients, AHL Funding provides a wealth of resources and innovative loan programs. Start your journey with AHL Funding by visiting the Broker Approval page. For specific cases or inquiries, AHL Funding’s Submit a Scenario page is your go-to resource, ensuring you have the support needed to navigate the mortgage process with confidence.

Our goal is to shape and build the next generation of mortgage lending with exceptional customer service, integrity, strength and experience.

© 2024 AHL Funding | Privacy Policy | Company NMLS: 1370963

AHL Funding DBA American Home Loans All rights reserved. www.nmlsconsumeraccess.org. Rates, fees and programs are subject to change without notice. Other restrictions may apply. AHL Funding DBA American Home Loans is a Wholesale Lender. We work with mortgage brokers to originate loans.

Subscribe to AHL Funding and recieve insider news, tips, and resources for loan officers.

*We never spam, unsubscribe any time.