Interest rates are a fundamental aspect of mortgage lending, influencing both the market’s dynamics and individual borrowers’ decisions. For loan officers, understanding how these rates work, what affects them, and how they impact different mortgage products is essential. This article aims to provide loan officers with crucial insights into navigating interest rates effectively.

1. Understanding Interest Rates

Interest rates, essentially the cost of borrowing money, are expressed as a percentage of the loan amount. They can vary widely based on several factors:

2. Types of Interest Rates

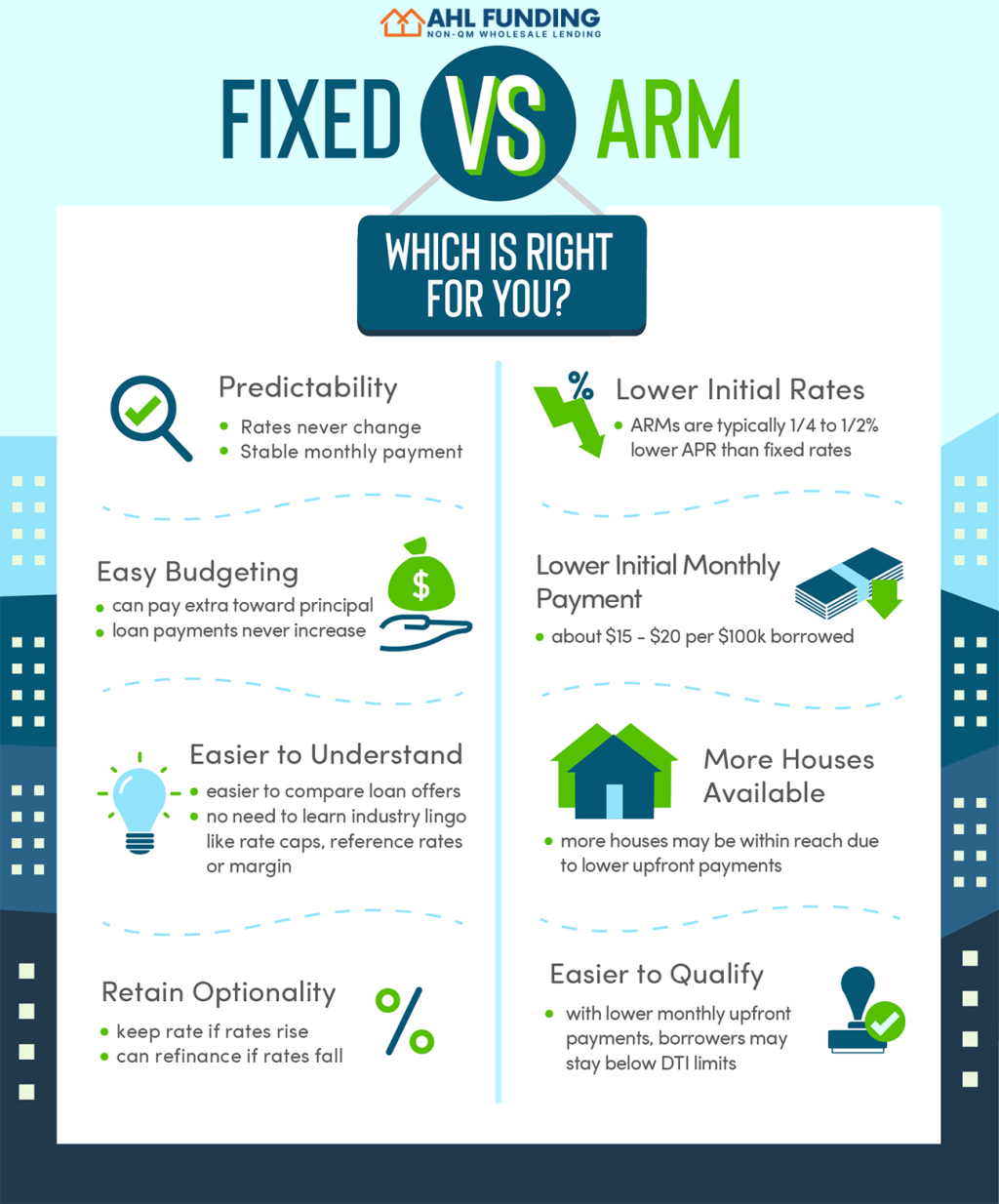

There are two main types of interest rates in mortgage lending:

3. The Impact of Interest Rates on Borrowers

Interest rates directly affect borrowers in several ways:

4. How Loan Officers Can Assist Clients

Loan officers play a pivotal role in helping clients navigate interest rates:

5. Staying Informed and Adapting Strategies

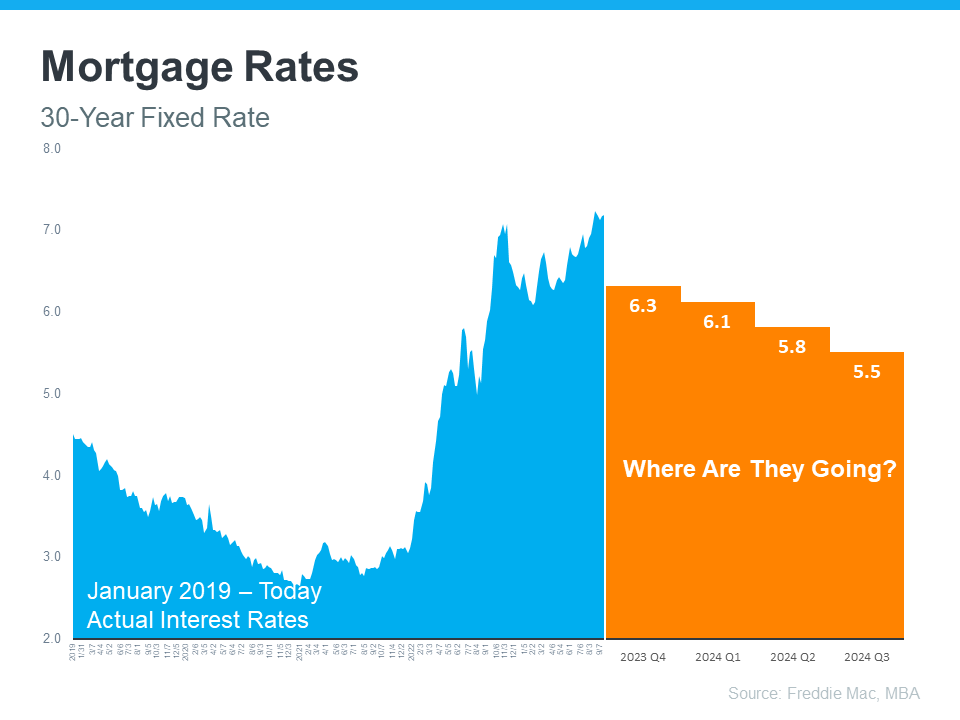

The mortgage industry is dynamic, and interest rates can fluctuate:

6. Long-Term Planning and Interest Rates

For those clients planning to stay in their homes long-term, a fixed-rate mortgage might be more advantageous. Conversely, for those expecting to move or refinance in a few years, an ARM could be a better fit.

Conclusion:

Interest rates are a critical component of mortgage lending, and a deep understanding of them is essential for any successful loan officer. By staying informed and proactively guiding clients, loan officers can help borrowers make savvy financial decisions in their home-buying journey.

To further enhance your expertise as a loan officer and to access a range of loan products suited to diverse needs, explore AHL Funding’s offerings. Begin by visiting AHL Funding’s Broker Approval page. For specific loan scenarios or guidance, AHL Funding’s Submit a Scenario page is an invaluable resource, ensuring you have the support and information needed to navigate the complexities of mortgage interest rates confidently.

Our goal is to shape and build the next generation of mortgage lending with exceptional customer service, integrity, strength and experience.

© 2024 AHL Funding | Privacy Policy | Company NMLS: 1370963

AHL Funding DBA American Home Loans All rights reserved. www.nmlsconsumeraccess.org. Rates, fees and programs are subject to change without notice. Other restrictions may apply. AHL Funding DBA American Home Loans is a Wholesale Lender. We work with mortgage brokers to originate loans.

Subscribe to AHL Funding and recieve insider news, tips, and resources for loan officers.

*We never spam, unsubscribe any time.