In the rapidly evolving mortgage industry, staying ahead means leveraging the latest tools and technologies. Loan origination software (LOS) is at the forefront of this technological revolution, offering loan officers a suite of features designed to streamline the lending process, enhance accuracy, and improve client satisfaction. This article delves into the world of LOS, exploring how these powerful platforms can transform the way loan officers work.

Understanding Loan Origination Software

LOS is a comprehensive system that automates and manages the loan origination process from application to funding. It integrates various functions such as:

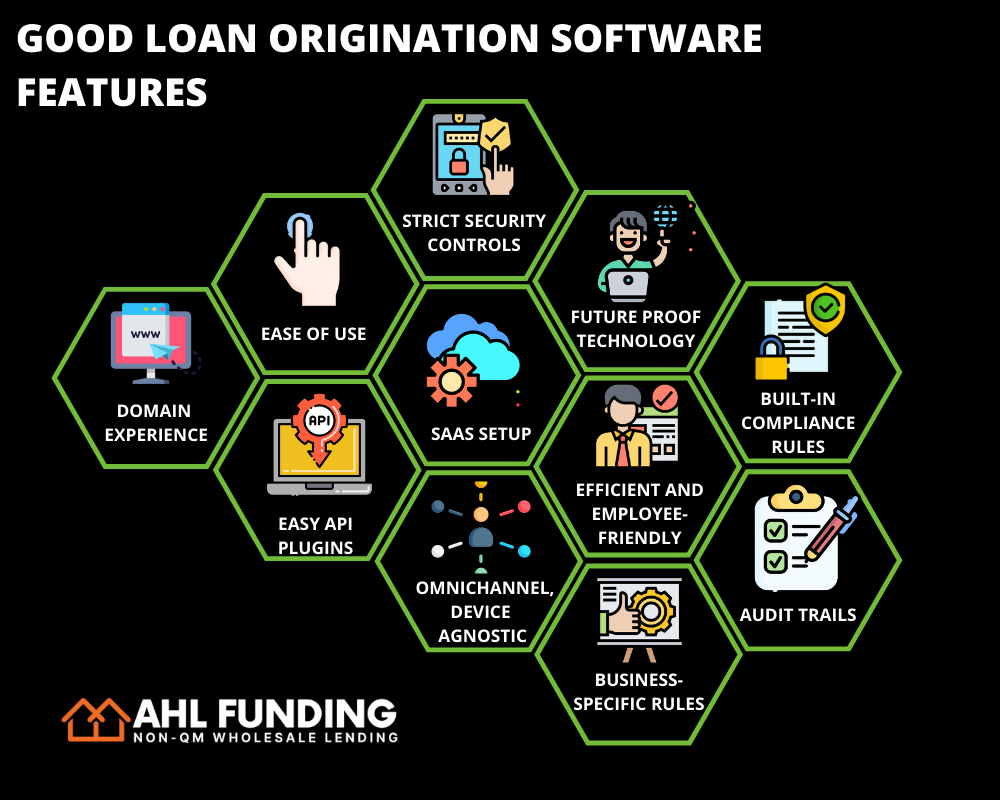

Key Features of Loan Origination Software

Benefits of Using LOS for Loan Officers

Adopting LOS can offer several advantages:

Choosing the Right Loan Origination Software

When selecting an LOS, consider:

13 Steps to Choosing the Right LOS

Staying Ahead with Technology

For loan officers, staying updated on the latest LOS features and industry best practices is crucial. Continuous learning and adaptation can significantly enhance service delivery and operational efficiency.

Conclusion:

Loan origination software is not just a tool; it’s a game-changer in the mortgage industry, enabling loan officers to provide quicker, more reliable, and more personalized services. By harnessing the power of LOS, loan officers can not only streamline their workflows but also elevate the client experience, setting the stage for long-term success in a competitive market.

For loan officers eager to embrace the latest in loan origination technology and expand their expertise, AHL Funding offers a supportive platform filled with resources and innovative loan solutions. To explore these opportunities, consider starting with AHL Funding’s Broker Approval process. For personalized assistance or to discuss specific scenarios, AHL Funding’s Submit a Scenario page is an invaluable resource, ensuring you’re equipped with the tools and knowledge to leverage LOS effectively and enhance your professional practice.

Our goal is to shape and build the next generation of mortgage lending with exceptional customer service, integrity, strength and experience.

© 2024 AHL Funding | Privacy Policy | Company NMLS: 1370963

AHL Funding DBA American Home Loans All rights reserved. www.nmlsconsumeraccess.org. Rates, fees and programs are subject to change without notice. Other restrictions may apply. AHL Funding DBA American Home Loans is a Wholesale Lender. We work with mortgage brokers to originate loans.

Subscribe to AHL Funding and recieve insider news, tips, and resources for loan officers.

*We never spam, unsubscribe any time.