In the mortgage industry, understanding the differences between jumbo loans and conforming loans is crucial for loan officers. This knowledge enables them to advise clients effectively, ensuring borrowers choose the loan product that best suits their financial needs and property aspirations. Let’s explore the key distinctions between these two loan types and what loan officers need to keep in mind.

Conforming Loans: The Basics

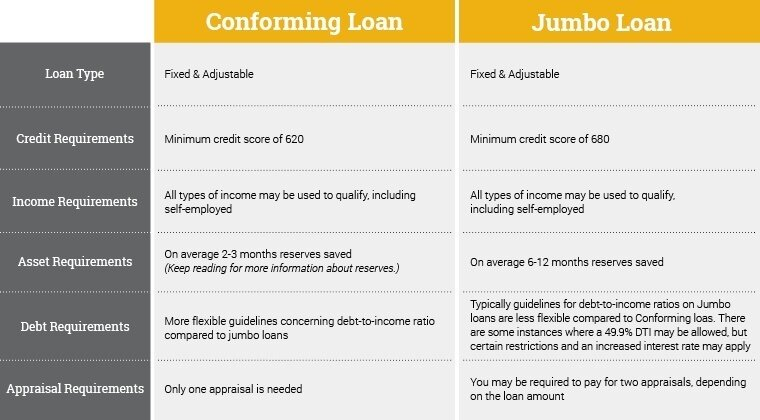

Conforming loans adhere to the maximum loan limits set by Fannie Mae and Freddie Mac, along with other guidelines such as credit score and debt-to-income ratios.

Jumbo Loans: Going Beyond the Standard

Jumbo loans exceed the loan limits set for conforming loans, making them suitable for financing high-value properties.

Key Differences Loan Officers Should Highlight

Advising Clients on Loan Selection

When guiding clients, consider:

Navigating the Approval Process

Loan officers should prepare clients for the approval process by:

Conclusion:

The choice between a jumbo loan and a conforming loan hinges on several factors, including the borrower’s financial health, the property’s price, and the local housing market. Loan officers play a pivotal role in guiding clients through this decision-making process, ensuring they secure a loan that aligns with their financial situation and homeownership goals.

For loan officers seeking to deepen their understanding of jumbo and conforming loans, AHL Funding offers resources and support to navigate these complex loan products. Enhance your professional capabilities by starting with AHL Funding’s Broker Approval. For specific inquiries or to submit loan scenarios, AHL Funding’s Submit a Scenario page is a valuable resource, providing expert assistance to ensure loan officers can confidently advise their clients.

Our goal is to shape and build the next generation of mortgage lending with exceptional customer service, integrity, strength and experience.

© 2024 AHL Funding | Privacy Policy | Company NMLS: 1370963

AHL Funding DBA American Home Loans All rights reserved. www.nmlsconsumeraccess.org. Rates, fees and programs are subject to change without notice. Other restrictions may apply. AHL Funding DBA American Home Loans is a Wholesale Lender. We work with mortgage brokers to originate loans.

Subscribe to AHL Funding and recieve insider news, tips, and resources for loan officers.

*We never spam, unsubscribe any time.