Refinancing is a pivotal aspect of mortgage management, offering borrowers the opportunity to adjust their loan terms to better suit their current financial situations or goals. For loan officers, a deep understanding of the refinancing process, its benefits, and its potential pitfalls is essential. This article serves as a comprehensive introduction to refinancing, highlighting what every loan officer should know to guide their clients effectively.

1. What is Refinancing?

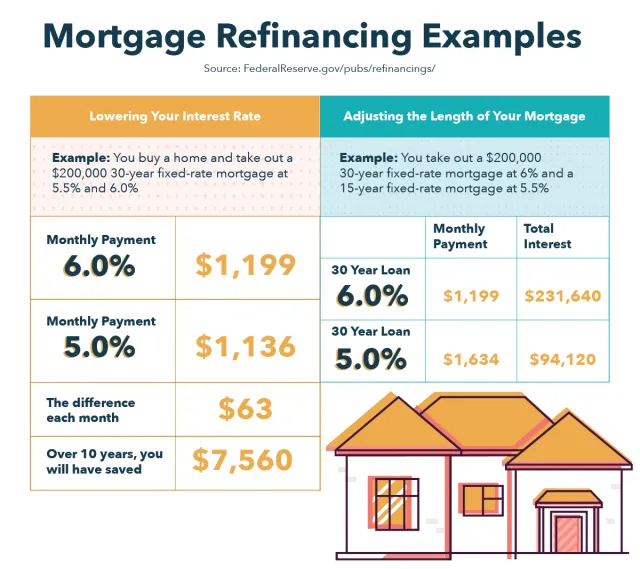

Refinancing involves replacing an existing mortgage with a new loan, typically under different terms. The reasons for refinancing can vary widely, from securing a lower interest rate to changing the loan’s duration or tapping into home equity.

2. Types of Refinancing

3. Benefits of Refinancing

4. Considerations and Risks

Refinancing isn’t free of downsides, and it’s crucial for loan officers to discuss these with clients:

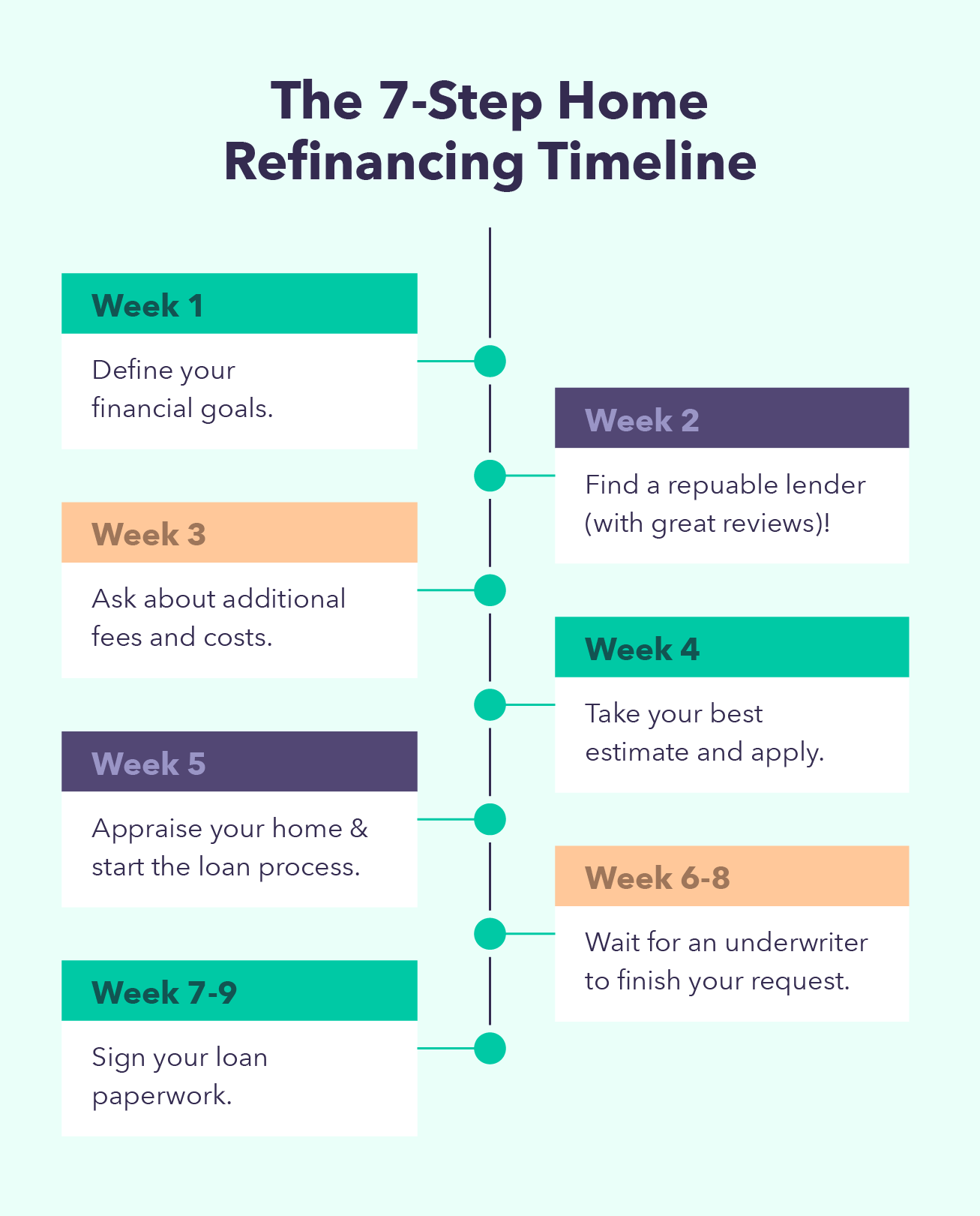

5. The Refinancing Process

Loan officers should guide clients through the refinancing process, which mirrors the original mortgage application process and includes:

6. Educating Clients on Refinancing

As a loan officer, providing clients with comprehensive information on refinancing is key. This includes:

Conclusion:

Refinancing is a powerful tool in mortgage management, offering various benefits under the right circumstances. For loan officers, mastering the intricacies of refinancing and communicating its advantages and considerations effectively is crucial. By doing so, they can provide invaluable guidance to clients looking to make informed refinancing decisions.

Loan officers aiming to expand their knowledge and services in refinancing can leverage the resources and support provided by AHL Funding. Discover more about how AHL Funding can assist in the refinancing process by visiting their Broker Approval page. For detailed inquiries or scenario submissions, AHL Funding’s Submit a Scenario page offers personalized support, ensuring loan officers are well-equipped to navigate the refinancing landscape with confidence.

Our goal is to shape and build the next generation of mortgage lending with exceptional customer service, integrity, strength and experience.

© 2024 AHL Funding | Privacy Policy | Company NMLS: 1370963

AHL Funding DBA American Home Loans All rights reserved. www.nmlsconsumeraccess.org. Rates, fees and programs are subject to change without notice. Other restrictions may apply. AHL Funding DBA American Home Loans is a Wholesale Lender. We work with mortgage brokers to originate loans.

Subscribe to AHL Funding and recieve insider news, tips, and resources for loan officers.

*We never spam, unsubscribe any time.