Navigating the diverse terrain of mortgage options is crucial for loan officers aiming to provide tailored solutions to their clients. This comprehensive guide delves into various mortgage products, highlighting their distinct features and ideal borrower profiles, equipping loan officers with the knowledge to guide their clients effectively.

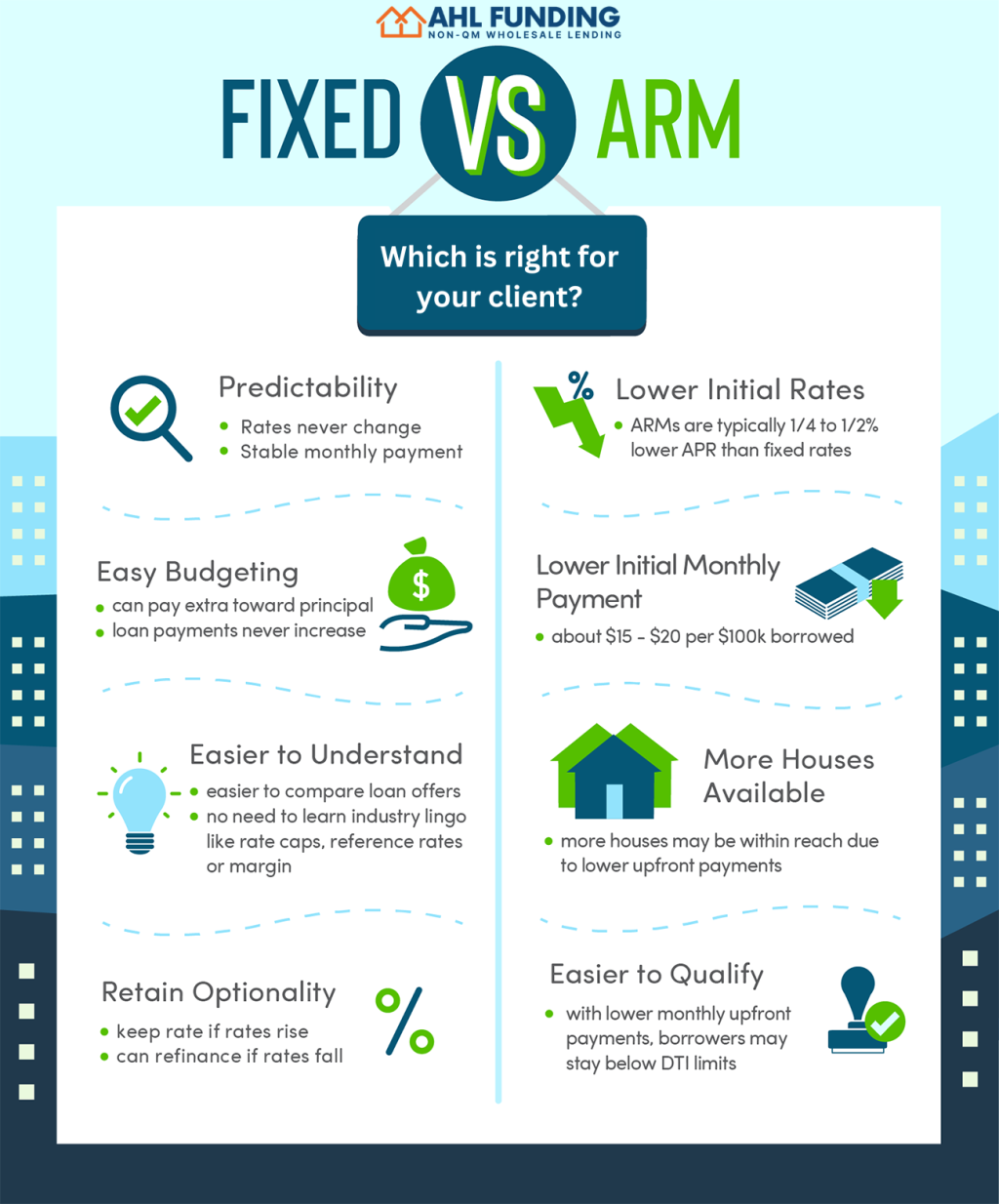

1. Fixed-Rate Mortgages (FRMs)

Characterized by their unchanging interest rate over the loan’s life, FRMs offer payment stability and predictability, making them a popular choice among borrowers seeking long-term security.

2. Adjustable-Rate Mortgages (ARMs)

ARMs start with a lower interest rate that adjusts over time based on market conditions. The initial lower rates provide short-term affordability but carry the risk of future rate increases.

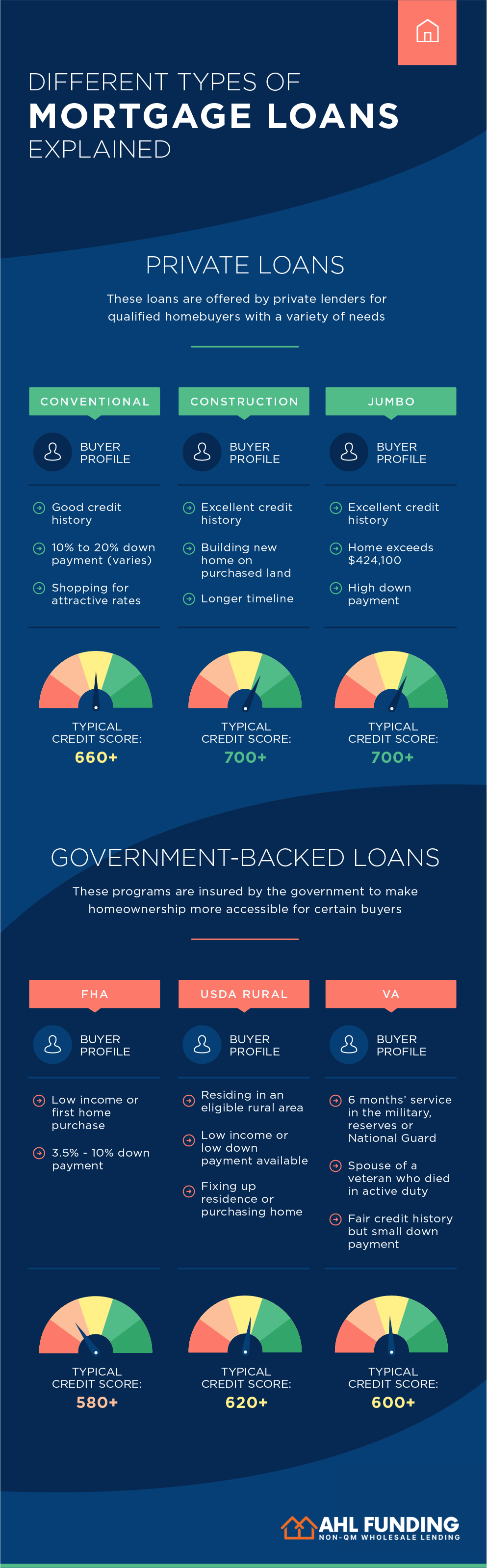

3. Government-Insured Loans

These loans, backed by government agencies, are designed to reduce lending risks, offering unique benefits to specific borrower groups:

4. Jumbo Loans

Exceeding the conforming loan limits, jumbo loans finance high-value properties, requiring strong credit profiles and substantial down payments from borrowers.

5. Interest-Only Mortgages

These mortgages allow for interest-only payments during the initial term, deferring principal payments to a later period, which can significantly lower initial monthly payments.

6. Balloon Mortgages

Featuring relatively low monthly payments, balloon mortgages culminate in a substantial lump-sum payment at the end of the term, requiring careful financial planning.

7. Reverse Mortgages

Available to senior homeowners, reverse mortgages convert home equity into cash, providing financial flexibility without the need to sell the property.

AHL Funding

The mortgage market’s breadth offers a loan product for nearly every borrower’s circumstance. For loan officers, mastering the nuances of these options is key to delivering personalized advice and solutions.

Loan officers looking to expand their understanding and offerings can turn to AHL Funding for a comprehensive suite of mortgage products and dedicated support. Enhance your professional capabilities by visiting AHL Funding’s Broker Approval page. For detailed product inquiries or client scenarios, AHL Funding’s Submit a Scenario page is an essential resource, ensuring you’re equipped to navigate the vast mortgage landscape confidently.

Our goal is to shape and build the next generation of mortgage lending with exceptional customer service, integrity, strength and experience.

© 2024 AHL Funding | Privacy Policy | Company NMLS: 1370963

AHL Funding DBA American Home Loans All rights reserved. www.nmlsconsumeraccess.org. Rates, fees and programs are subject to change without notice. Other restrictions may apply. AHL Funding DBA American Home Loans is a Wholesale Lender. We work with mortgage brokers to originate loans.

Subscribe to AHL Funding and recieve insider news, tips, and resources for loan officers.

*We never spam, unsubscribe any time.